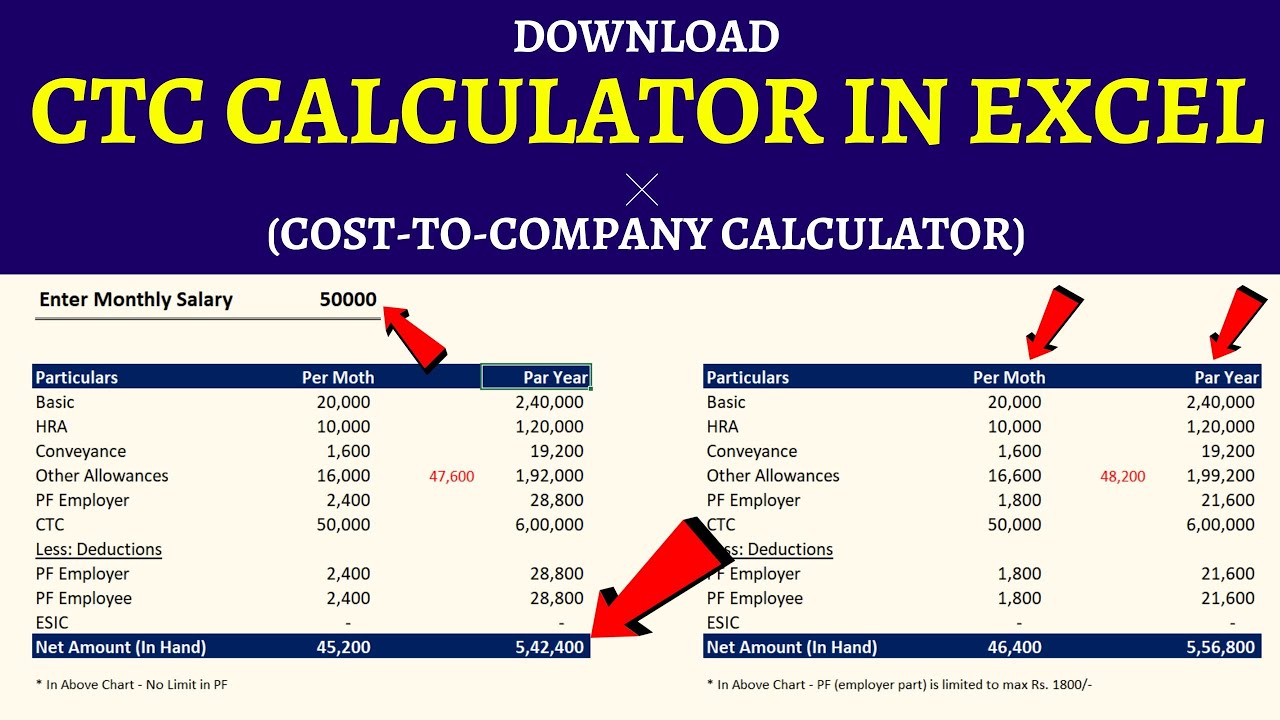

Ctc Payments 2025 Calculator Program. Ctc = (monthly salary *. Department of the treasury and the internal revenue service announced today that the first monthly payment of the expanded and.

Download CTC Calculator in Excel 📊 Calculator) YouTube, The house passed the tax relief for american families and workers act of 2025, introducing expansions to the. Since july, millions of families have received monthly child tax credit payments of up to $300 per child.

Online Monthly Salary To CTC Calculator 2025, That means they'll receive $167 per child who is 17 or younger through december, representing half of the $2,000 regular ctc. Use our monthly child tax credit calculator to estimate how much you might receive.

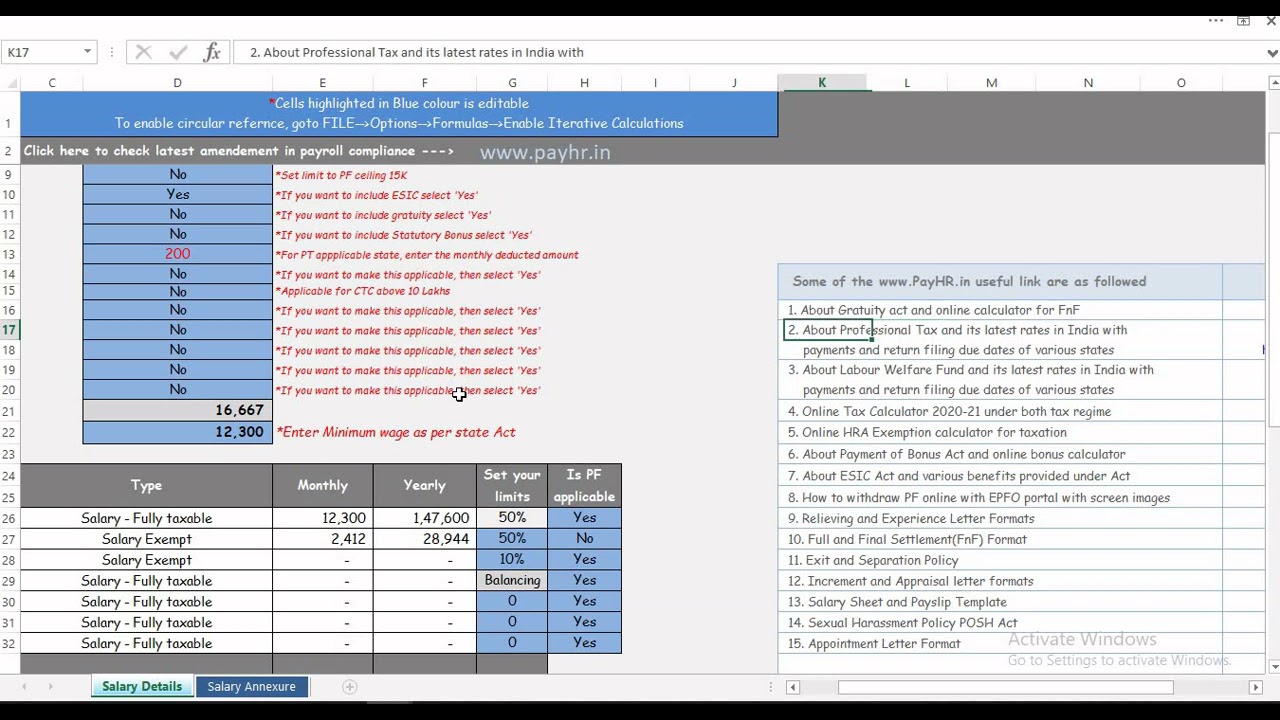

How to use PayHR Excel CTC Calculator YouTube, Since july, millions of families have received monthly child tax credit payments of up to $300 per child. The april 15, 2025, payment will be the canada.

CTC Calculator in Excel Download Calculator), Department of the treasury and the internal revenue service announced today that the first monthly payment of the expanded and. In detail, the latest child tax credit scheme allows each family to claim up to $3,600 for every child below the age of 6, and up to $3,000 for every child below the age.

New Online Tool Helps Families Register for Advance CTC, Ctc = (monthly salary *. Department of the treasury and the internal revenue service announced today that the first monthly payment of the expanded and.

Understanding The Ctc Payment Schedule A Guide For 2025 Denver, Understand that the credit does not affect their federal benefits. Ctc = (monthly salary *.

2025 Child Tax Credit Calculator Internal Revenue Code Simplified, Ctc = (monthly salary *. Department of the treasury announced today that the first monthly payment of the.

SALARY 2025 How to Calculate CTC, Salary & Tax 2025 New, The child tax credit (ctc) is one of the most important tax cuts for working families in more than a generation. Find out if they are eligible to receive the child tax credit.

What Families Need to Know about the CTC in 2025 CLASP, To get money to families sooner, the irs is sending families half of their 2025 child tax credit (childctc) as monthly payments of $300 per child under age 6 and $250 per child between the ages. Ctc = (monthly salary *.

What are CTC advance payments (Child Tax Credit Advance Payments, To get money to families sooner, the irs is sending families half of their 2025 child tax credit (childctc) as monthly payments of $300 per child under age 6 and $250 per child between the ages. The child tax credit ( ctc ) will reset from a maximum of $3,600 to $2,000 per child for 2025.

That means they'll receive $167 per child who is 17 or younger through december, representing half of the $2,000 regular ctc.